A new reporting requirement went into effect on January 1, 2024 that requires millions of businesses with qualifying entities to file a Beneficial Ownership Information (BOI) Report with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN). Congress imposed this requirement in a statute called the Corporate Transparency Act (CTA), with FinCEN issuing the regulation providing the details on who must file a BOI report, when the report has to be filed, and what information has to be reported.

Attendees will learn about:

• What is the Corporate Transparency Act

• Who is—and who isn’t—required to report BOI

• When, where, and how BOI reports are filed

• The benefits of working with a trusted provider to simplify CTA complexity

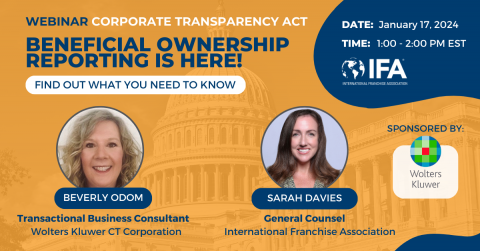

Your expert guide:

Beverly Odom

Transactional Business Consultant

Wolters Kluwer CT Corporation

Beverly is a UCC and transactional subject matter expert for Wolters Kluwer CT Corporation clients. She focuses on corporate compliance issues arising in the context of financial closings, M&A, real estate transactions, corporate formations and dissolutions, and corporate reorganizations, among others.

*To receive CFE credits for attending this event, please register using the email address associated with your IFA account.

Per IFA the Privacy Policy (https://www.franchise.org/privacy-policy), IFA Conference and Event attendee business contact information may be shared with other attendees and event sponsors.